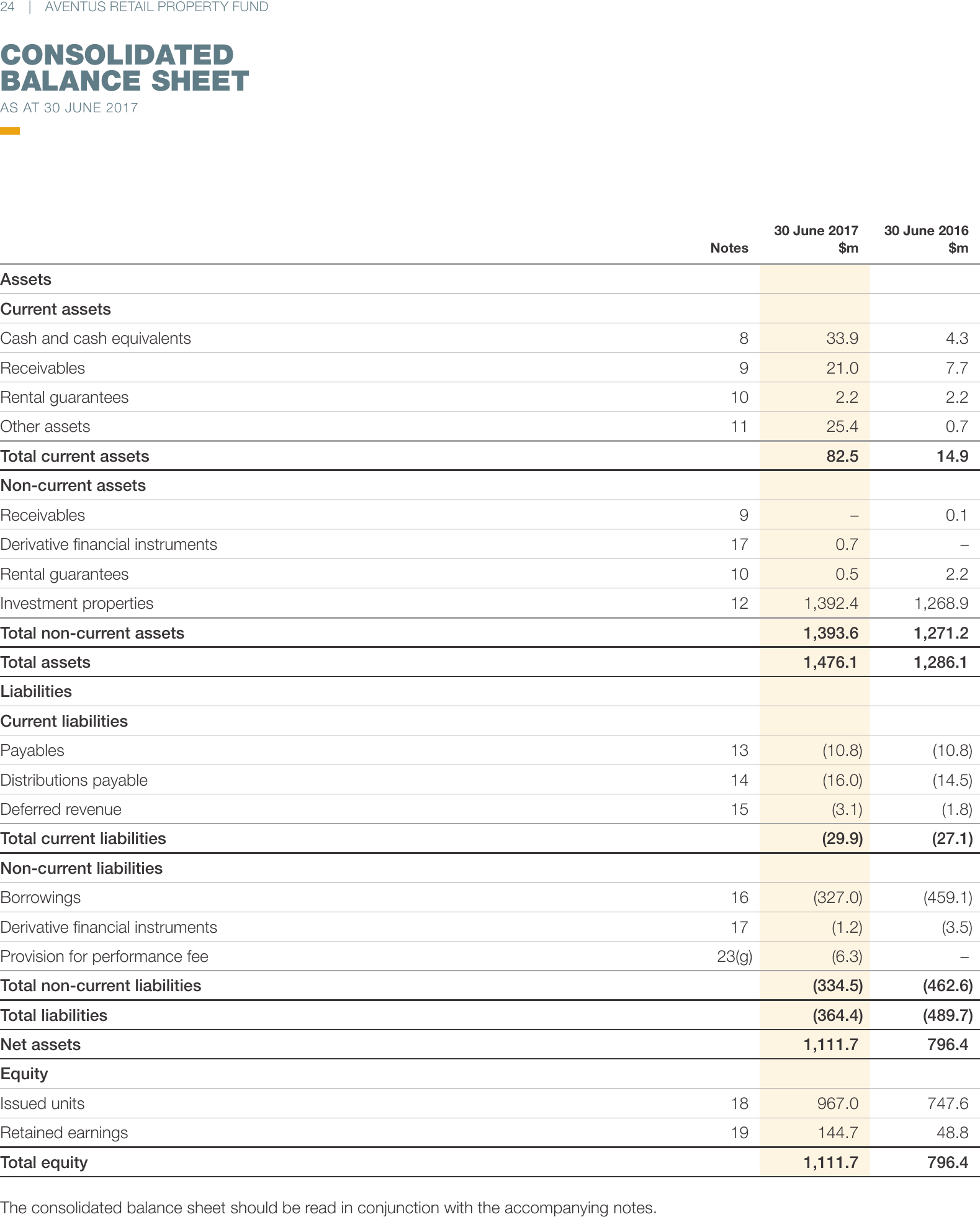

24 | AVENTUS RETAIL PROPERTY FUND

CONSOLIDATED

BALANCE SHEET

AS AT 30 JUNE 2017

Notes

30 June 2017

$m

30 June 2016

$m

Cash and cash equivalents

8

33.9

4.3

Receivables

9

21.0

7.7

Rental guarantees

10

2.2

2.2

Other assets

11

25.4

0.7

82.5

14.9

9

–

0.1

Derivative financial instruments

17

0.7

–

Rental guarantees

10

0.5

2.2

Investment properties

12

1,392.4

1,268.9

Total non-current assets

1,393.6

1,271.2

Total assets

1,476.1

1,286.1

Assets

Current assets

Total current assets

Non-current assets

Receivables

Liabilities

Current liabilities

Payables

13

(10.8)

(10.8)

Distributions payable

14

(16.0)

(14.5)

Deferred revenue

15

(3.1)

(1.8)

(29.9)

(27.1)

Total current liabilities

Non-current liabilities

Borrowings

16

(327.0)

(459.1)

Derivative financial instruments

17

(1.2)

(3.5)

Provision for performance fee

23(g)

(6.3)

–

Total non-current liabilities

(334.5)

(462.6)

Total liabilities

(364.4)

(489.7)

1,111.7

796.4

967.0

747.6

Net assets

Equity

Issued units

18

Retained earnings

19

Total equity

The consolidated balance sheet should be read in conjunction with the accompanying notes.

144.7

48.8

1,111.7

796.4