6 | AVENTUS RETAIL PROPERTY FUND

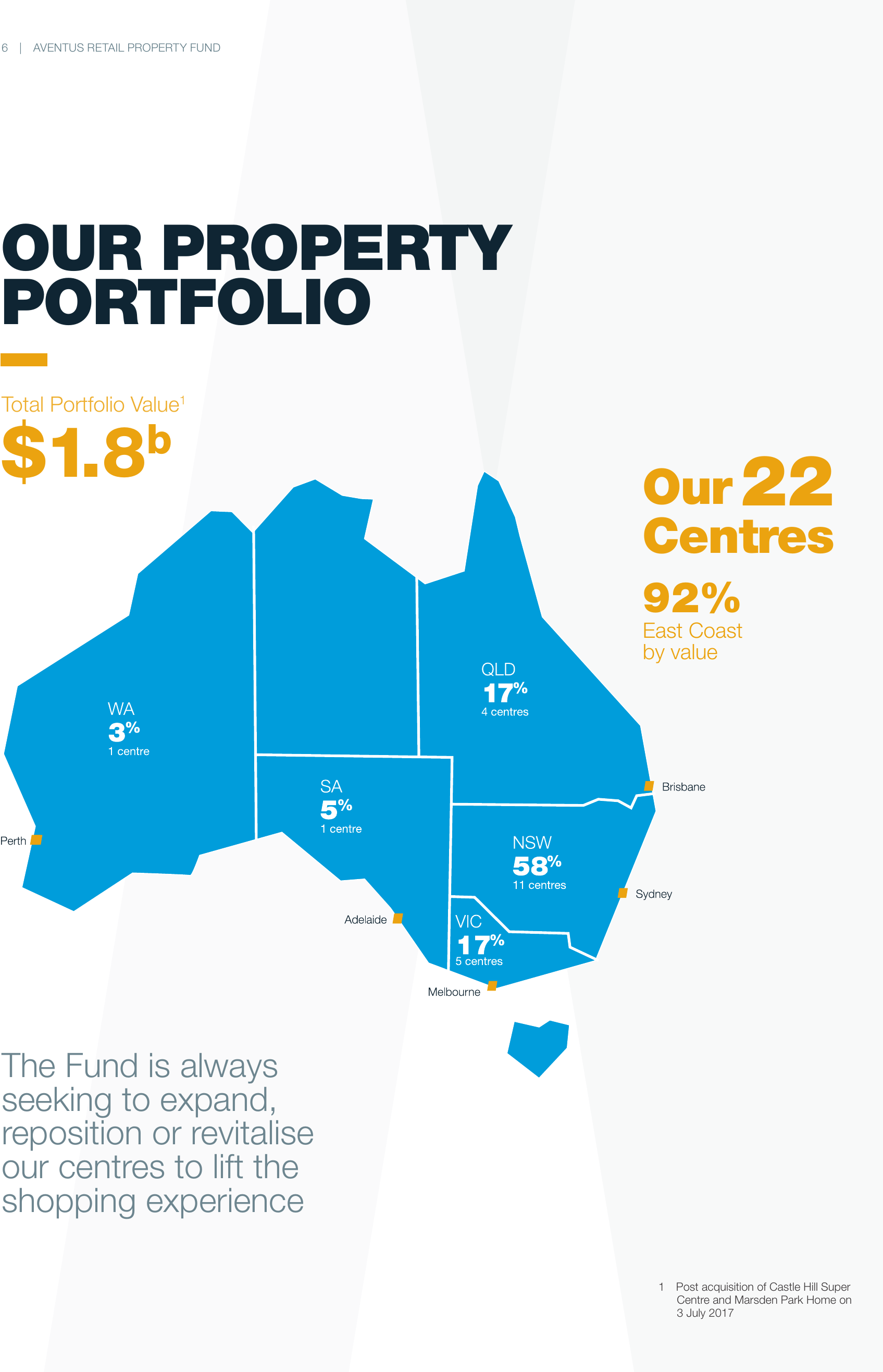

OUR PROPERTY

PORTFOLIO

Total Portfolio Value1

$1.8

b

Our 22

Centres

92%

East Coast

by value

The Fund is always

seeking to expand,

reposition or revitalise

our centres to lift the

shopping experience

1 Post acquisition of Castle Hill Super

Centre and Marsden Park Home on

3 July 2017

ANNUAL REPORT 2017 | 7

Centre

30 June

2017

value

(A$m)

Cap

rate

(%)

GLA

('000

sqm)4

Site

Area

('000

sqm)

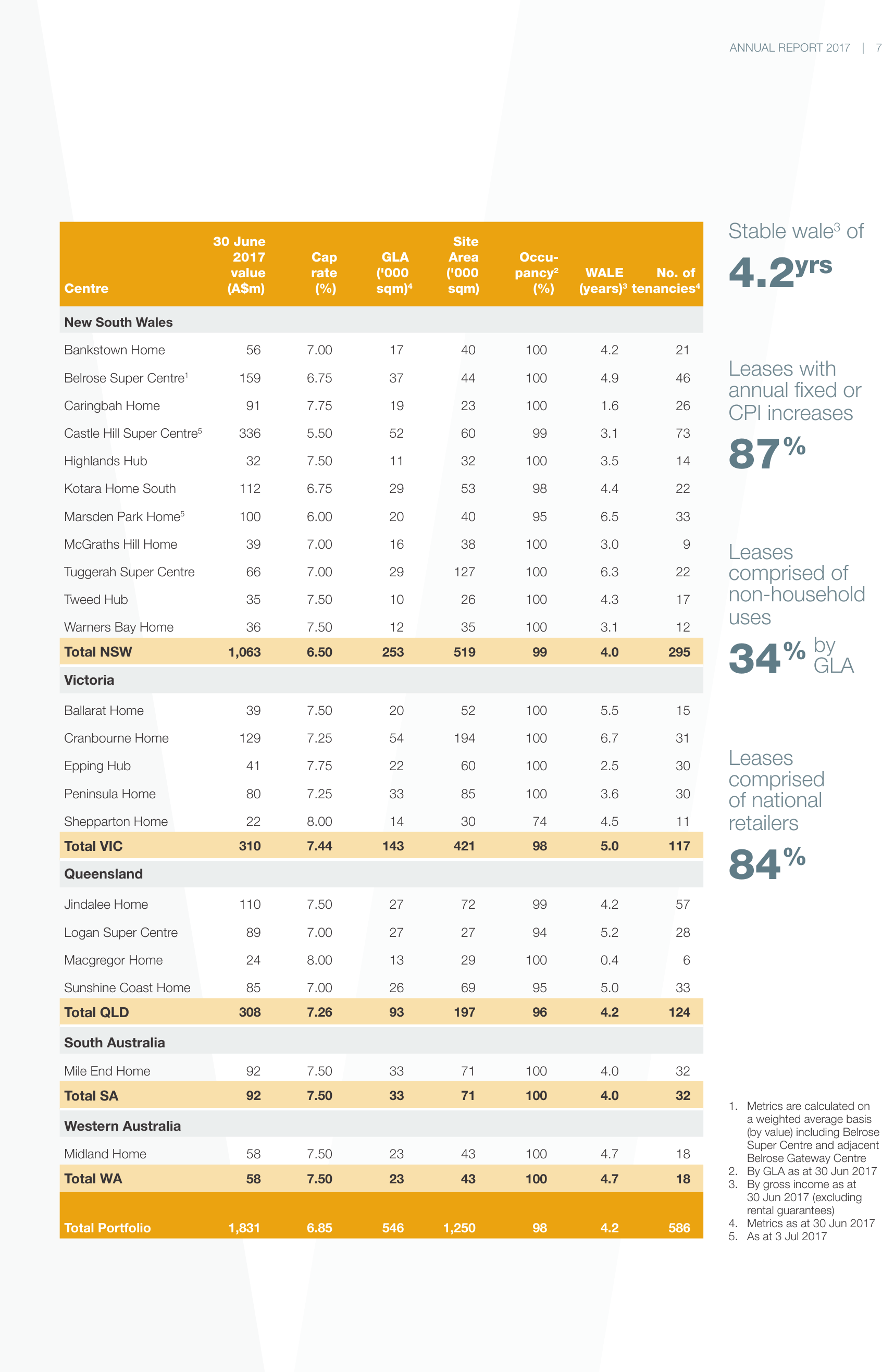

Stable wale3 of

Occupancy2

(%)

WALE

No. of

(years)3 tenancies4

4.2yrs

New South Wales

Bankstown Home

56

7.00

17

40

100

4.2

21

159

6.75

37

44

100

4.9

46

91

7.75

19

23

100

1.6

26

336

5.50

52

60

99

3.1

73

32

7.50

11

32

100

3.5

14

Kotara Home South

112

6.75

29

53

98

4.4

22

Marsden Park Home5

100

6.00

20

40

95

6.5

33

McGraths Hill Home

39

7.00

16

38

100

3.0

9

Tuggerah Super Centre

66

7.00

29

127

100

6.3

22

Tweed Hub

35

7.50

10

26

100

4.3

17

Warners Bay Home

36

7.50

12

35

100

3.1

12

1,063

6.50

253

519

99

4.0

295

39

7.50

20

52

100

5.5

15

129

7.25

54

194

100

6.7

31

Epping Hub

41

7.75

22

60

100

2.5

30

Peninsula Home

80

7.25

33

85

100

3.6

30

Shepparton Home

22

8.00

14

30

74

4.5

11

310

7.44

143

421

98

5.0

117

110

7.50

27

72

99

4.2

57

Logan Super Centre

89

7.00

27

27

94

5.2

28

Macgregor Home

24

8.00

13

29

100

0.4

6

Sunshine Coast Home

85

7.00

26

69

95

5.0

33

308

7.26

93

197

96

4.2

124

Mile End Home

92

7.50

33

71

100

4.0

32

Total SA

92

7.50

33

71

100

4.0

32

Midland Home

58

7.50

23

43

100

4.7

18

Total WA

58

7.50

23

43

100

4.7

18

1,831

6.85

546

1,250

98

4.2

586

Belrose Super Centre1

Caringbah Home

Castle Hill Super Centre5

Highlands Hub

Total NSW

Victoria

Ballarat Home

Cranbourne Home

Total VIC

Queensland

Jindalee Home

Total QLD

Leases with

annual fixed or

CPI increases

87%

Leases

comprised of

non-household

uses

% by

GLA

34

Leases

comprised

of national

retailers

84%

South Australia

Western Australia

Total Portfolio

1. Metrics are calculated on

a weighted average basis

(by value) including Belrose

Super Centre and adjacent

Belrose Gateway Centre

2. By GLA as at 30 Jun 2017

3. By gross income as at

30 Jun 2017 (excluding

rental guarantees)

4. Metrics as at 30 Jun 2017

5. As at 3 Jul 2017