16 | AVENTUS RETAIL PROPERTY FUND

DIRECTORS’

REPORT

The directors of Aventus Capital Limited (“the Responsible Entity”), the responsible entity of Aventus Retail Property Fund (“the Fund”),

present their report together with the consolidated financial statements of the Fund and its consolidated entities (“the Group”) for the

financial year ended 30 June 2017.

Directors and secretaries

The following persons held office as directors of the Responsible Entity during the whole of the financial year and up to the date of this

report, unless otherwise stated:

yy Bruce Carter

Independent Non-Executive Chairman

yy Darren Holland

Executive Director

yy Kieran Pryke

Independent Non-Executive Director

yy Robyn Stubbs

Independent Non-Executive Director

yy Tracey Blundy

Non-Executive Director (resigned 18 August 2016)

yy Nico van der Merwe

Non-Executive Director (appointed 18 August 2016)

yy Brett Blundy

Alternate Director to Nico van der Merwe (appointed 18 August 2016)

The company secretaries of the Responsible Entity are Mary Weaver AGIA and Lawrence Wong.

Principal activity

The principal activity of the Group during the financial year was investment in large format retail property assets. There was no significant

change in the Group’s principal activity during the financial year.

Review of operations and results

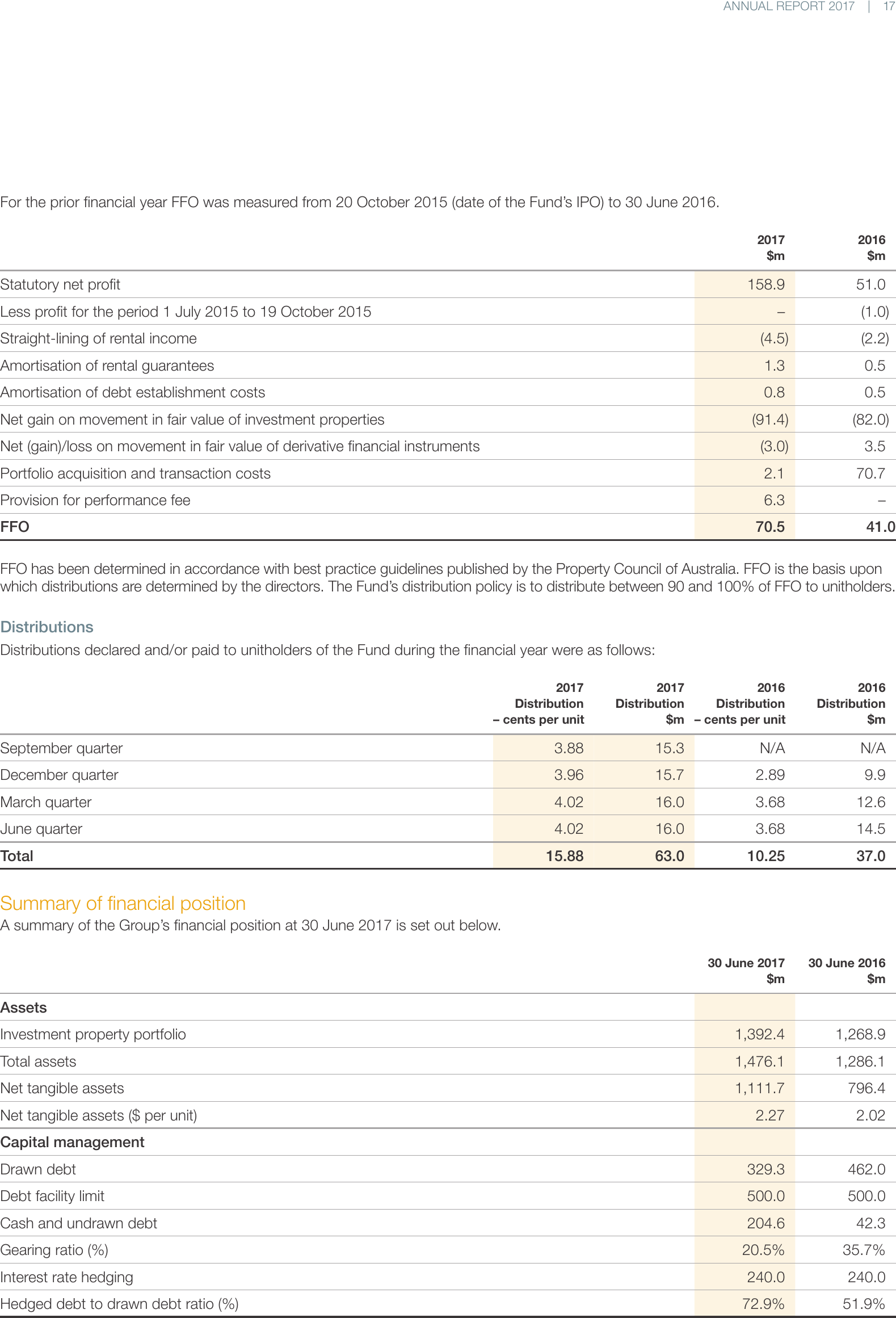

Summary of financial performance

A summary of the Group’s financial performance for the financial year is set out below.

2017

$m

2016

$m

Net profit for the financial year

158.9

51.0

Funds from operations (“FFO”)

70.5

41.0

FFO per unit (cents)

17.7

11.7

Basic and diluted earnings per unit (cents)

39.2

18.3

Distributions to unitholders

63.0

37.0

Distributions to unitholders (cents)

15.9

10.3

The increase in net profit during the financial year is mainly attributable to:

yy the acquisition of Bankstown Home, Logan Super Centre, MacGregor Home, McGraths Hill Home and Shepparton Home in May 2016;

yy the acquisition of Epping Hub and Belrose Gateway Centre in December 2015;

yy the 13 properties acquired in conjunction with the Fund’s initial public offering in October 2015; and

yy in the impact of IPO and business combination acquisition costs incurred in the prior financial year.

FFO

The table below provides a reconciliation between the statutory net profit for the financial year and FFO. FFO represents the net profit

for the year adjusted for:

yy straight-lining of rental income;

yy amortisation of rental guarantees;

yy amortisation of debt establishment costs;

yy unrealised fair value gains or losses on investment properties;

yy unrealised fair value gains or losses on derivative financial instruments;

yy portfolio acquisition and transaction costs;

yy provision for performance fee; and

yy other non-cash or non-recurring amounts outside core operating activities.

ANNUAL REPORT 2017 | 17

For the prior financial year FFO was measured from 20 October 2015 (date of the Fund’s IPO) to 30 June 2016.

2017

$m

158.9

Statutory net profit

Less profit for the period 1 July 2015 to 19 October 2015

2016

$m

51.0

–

(1.0)

Straight-lining of rental income

(4.5)

(2.2)

Amortisation of rental guarantees

1.3

0.5

Amortisation of debt establishment costs

0.8

0.5

(91.4)

(82.0)

Net gain on movement in fair value of investment properties

Net (gain)/loss on movement in fair value of derivative financial instruments

(3.0)

3.5

Portfolio acquisition and transaction costs

2.1

70.7

Provision for performance fee

6.3

–

70.5

41.0

FFO

FFO has been determined in accordance with best practice guidelines published by the Property Council of Australia. FFO is the basis upon

which distributions are determined by the directors. The Fund’s distribution policy is to distribute between 90 and 100% of FFO to unitholders.

Distributions

Distributions declared and/or paid to unitholders of the Fund during the financial year were as follows:

2017

Distribution

– cents per unit

2017

2016

Distribution

Distribution

$m – cents per unit

2016

Distribution

$m

September quarter

3.88

15.3

N/A

N/A

December quarter

3.96

15.7

2.89

9.9

March quarter

4.02

16.0

3.68

12.6

June quarter

4.02

16.0

3.68

14.5

15.88

63.0

10.25

37.0

30 June 2017

$m

30 June 2016

$m

Investment property portfolio

1,392.4

1,268.9

Total assets

1,476.1

1,286.1

Net tangible assets

1,111.7

796.4

2.27

2.02

Drawn debt

329.3

462.0

Debt facility limit

500.0

500.0

Cash and undrawn debt

204.6

42.3

20.5%

35.7%

Total

Summary of financial position

A summary of the Group’s financial position at 30 June 2017 is set out below.

Assets

Net tangible assets ($ per unit)

Capital management

Gearing ratio (%)

Interest rate hedging

Hedged debt to drawn debt ratio (%)

240.0

240.0

72.9%

51.9%

18 | AVENTUS RETAIL PROPERTY FUND

DIRECTORS’

REPORT

(continued)

Review of operations and results (continued)

Summary of financial position (continued)

Investment property portfolio

yy At 30 June 2017, the Group owned 20 large format retail investment properties across Australia with a combined value of $1,392.4 million

(exclusive of rental guarantees). The weighted average capitalisation rate of the portfolio at 30 June 2017 was 7.24% (30 June 2016: 7.53%).

yy On 3 July 2017, the Group settled Home Hub Castle Hill and Home Hub Marsden Park for $436.0 million. The acquisition was funded

via a $214.7 million accelerated non-renounceable entitlement offer and a $300.0 million increase the Group’s debt facility. Additional

details of the acquisition and the impact on the Group subsequent to balance date are disclosed in note 27 to the financial statements.

yy The Group also acquired additional land adjacent to the Tuggerah Super Centre on 1 July 2016 for $4.0 million inclusive of $0.2 million

of transaction costs.

yy In relation to development activities, the Group completed the expansion of the Belrose Super Centre during the financial year adding

an additional 2,262 square metres of retail GLA to the existing rooftop carpark. The Group also commenced the redevelopment of the

former Bunnings tenancy at Sunshine Coast Home and the construction of the portfolio’s first child care centre at Cranbourne Home.

Debt and hedging activities

yy Gearing decreased from 35.7% at 30 June 2016 to 20.5% at 30 June 2017. The decrease is attributable to a temporary $160.0 million

repayment of debt in June 2017 on partial receipt of funds raised from the entitlement offer. On settlement of the Home Hub Castle Hill

and Home Hub Marsden Park acquisitions the gearing ratio increased to 38.9%.

yy The Group continued to comply with and maintain significant headroom for all debt covenants during the financial year ended 30 June 2017.

yy No additional interest rate swaps were entered into during the financial year. Hedging coverage as a percentage of drawn debt increased

from 51.9% at 30 June 2016 to 72.9% at 30 June 2017 due to the temporary debt repayment in June 2017.

yy The Group also entered into a 3 year $5 million bank guarantee facility on 14 September 2016. Drawn bank guarantees represent

contingent liabilities of the Group and do not form part of total debt disclosed in the balance sheet. Additional details of the facility

are disclosed in note 29 to the financial statements.

Significant changes in state of affairs

With the exception of property acquisitions and redevelopments outlined in the “review of operations” section above there were no other

significant changes in the state of affairs of the Group during the financial year.

Business strategies and prospects for future financial years

The Group will continue to engage in its principal activity and be managed by the Responsible Entity in accordance with the investment

objectives and guidelines as set out in the governing documents of the Fund and in accordance with the provisions of the Fund’s constitution.

The key business strategies of the Group include:

yy

yy

yy

yy

optimising the tenancy mix across the portfolio through proactive management and leasing leverage;

executing on future development projects;

participating in sector consolidation through acquisition of additional centres;

monitor potential regulatory changes in the LFR sector which could enable a broader range of tenants to occupy centres within

the portfolio; and

yy focused capital management.

Information on directors

The following information is current as at the date of this report.

Bruce Carter

Independent non-executive chairman

Experience and expertise

Bruce has spent over 30 years in corporate recovery and insolvency. Bruce is a consultant at Ferrier Hodgson

in Adelaide where he was previously the managing partner for 19 years. He was formerly a partner at Ernst

& Young, Chair of the South Australian Economic Development Board and a member of the Executive

Committee of Cabinet.

Bruce is currently Chair of the Australian Submarine Corporation, Deputy Chair of SkyCity Entertainment

Group Limited and a director of the Bank of Queensland Limited. He holds a Masters of Business

Administration from Heriot-Watt University and a Bachelor of Economics from University of Adelaide.

He is a Fellow of both the Institute of Chartered Accountants in Australia and the Australian Institute

of Company Directors.

Other current listed and

government directorships

ASC Pty Limited

SkyCity Entertainment Group Limited

Bank of Queensland Limited

Special responsibilities

Chairman

Member of the Audit, Risk and Compliance Committee

Interest in units in the Fund

919,312

ANNUAL REPORT 2017 | 19

Darren Holland

Executive director

Experience and expertise

Darren has more than 25 years experience in the retail property industry. He is experienced in leasing,

development, asset management and acquisitions, and has grown assets under management from one

centre in 2004 to 22 centres at the date of this report, valued at $1.8 billion.

Prior to joining the Aventus Property Group, Darren played a leading role in the development and

management of the only pure-play listed Australian LFR owner and operator to date, Homemaker Retail

Group (ASX: HRP). He holds a Bachelor of Business (Land Economics) from the University of Western

Sydney and is a Registered Valuer and Licensed Real Estate Agent.

Other current listed

directorships

None

Special responsibilities

None

Interest in units in the Fund

2,264,077

Kieran Pryke

Independent non-executive director

Experience and expertise

Kieran has over 25 years experience in the property industry. He spent nine years in various finance

roles across the construction, development and investment management divisions within Lend Lease

Corporation before becoming CFO of General Property Trust (“GPT”) in 1996. He remained as CFO of GPT

during and after the internalisation of management of GPT. Kieran was CFO of Australand Property Group

between 2010 and 2014. He is currently CFO of Grocon Pty Limited.

Kieran holds a Bachelor of Commerce (Accounting) from the University of Wollongong and is a Fellow

of CPA Australia.

Other current listed and

not-for-profit directorships

Ozharvest Limited

Special responsibilities

Chairman of the Audit, Risk and Compliance Committee

Interest in units in the Fund

70,873

Robyn Stubbs

Independent non-executive director

Experience and expertise

Robyn is a Board Director and Executive Coach working across the commercial, government and

not-for-profit sectors. Drawing on a successful 25+ year career as a senior executive in large, complex

organisations, Robyn sits on the Board of ASX-listed Invocare Limited as well as Lifeline Northern

Beaches. She provides Executive Coaching services to a diverse range of corporate clients via Executive

Coaching International (ECI).

Prior to joining the Aventus Board in 2015, Robyn spent 8 years with Stockland as a General Manager,

her last role heading up Retail Leasing across a portfolio of 40 shopping centres nationally.

Robyn is a graduate of the Australian Institute of Company Directors, she holds a Master of Science degree

in Coaching Psychology from The University of Sydney and was awarded a University Medal with her

business degree from the University of Technology, Sydney.

Other current listed and

not-for-profit directorships

Lifeline Northern Beaches

Special responsibilities

Member of the Audit, Risk and Compliance Committee

Interest in units in the Fund

28,349

Nico van der Merwe

Non-executive director

Experience and expertise

Nico joined BB Retail Capital Pty Limited (BBRC) in 1997. He has held a number of senior finance roles

across BBRC and is currently the Group Chief Financial Officer.

Invocare Limited

Nico has over 30 years experience in commercial roles across the retail, real estate and cattle industry

sectors. He holds Bachelor of Accounting Science (Hons) and Bachelor of Commerce degrees and is a

member of the Institute of Chartered Accountants in Australia.

Other current listed and

not-for-profit directorships

None

Special responsibilities

None

Interest in units in the Fund

159,374

20 | AVENTUS RETAIL PROPERTY FUND

DIRECTORS’

REPORT

(continued)

Information on directors (continued)

Brett Blundy

Alternate non-executive director

Experience and expertise

Brett is as an alternate director for Nico van der Merwe.

Brett is a substantial unitholder in the Fund and is also the majority shareholder of the Aventus Property

Group which provides funds and property management services to the Group.

Brett is also Chairman and Founder of BBRC. BBRC is a pre-eminent private investment group with diverse

interests across three key portfolios including global retail brands, retail properties and the beef industry.

BBRC is also a founding shareholder of Sydney’s BridgeClimb.

Brett also sits on the Board of Directors of Human Longevity Inc.

Other current listed and

not-for-profit directorships

Human Longevity Inc

Special responsibilities

None

Interest in units in the Fund

142,643,925

Remuneration report

The directors of the Responsible Entity are remunerated by the Aventus Property Group. Director fees of independent non-executive

directors of the Responsible Entity are reimbursed by the Fund. Details of these fees are outlined in note 23(b) to the financial statements.

Responsible Entity’s interests in the Fund

The Responsible Entity did not hold any units in the Fund at balance date.

Fees paid to the Responsible Entity and associates

Fees paid to the Responsible Entity and associates during the financial year are disclosed in note 23(c) to the financial statements.

Interests in the Fund

The number of units in the Fund issued during the financial year and the total number of units on issue at 30 June 2017 are disclosed

in note 18 to the financial statements.

Units under option

No options over unissued units were granted during the financial year. There were no units under option at 30 June 2017 or at the date

of this report.

Environmental regulations

The Group’s development activities are subject to development approvals and environmental regulations under Commonwealth,

State and local government legislation. To the best of the directors’ knowledge, development activities during the financial year have been

undertaken in compliance with development approvals and applicable environmental regulations.

Events occurring after the reporting period

With the exception of those events disclosed in note 27 to the financial statements there has not been any matter or circumstance

occurring subsequent to the end of the financial year that has significantly affected, or may significantly affect, the operations of the Group,

the results of those operations, or the state of affairs of the Group in future financial years.

ANNUAL REPORT 2017 | 21

Insurance of officers and indemnities

No insurance premiums are paid for out of the assets of the Group in regards to insurance cover provided to either the officers of the

Responsible Entity or the auditors of the Fund.

So long as the officers of the Responsible Entity act in accordance with the Fund’s constitution and the law, the officers remain indemnified

out of the assets of the Group against losses incurred while acting on behalf of the Group.

To the extent permitted by law, the Responsible Entity has agreed to indemnify the auditors of the Fund, Ernst & Young, as part of the

terms of its audit engagement agreement, against claims by third parties arising from the audit except for any loss in respect of any

matters which are finally determined to have resulted from Ernst & Young’s negligent, wrongful or wilful acts or omissions. No payment

has been made to indemnify Ernst & Young during or since the financial year.

Audit and non-audit services

Details of amounts paid or payable to the Fund’s auditors for audit and non-audit services during the financial year are disclosed in

note 30 to the financial statements.

The Responsible Entity is satisfied that the provision of non-audit services did not compromise the auditor’s independence requirements

under the Corporations Act 2001 as:

yy all non-audit services have been reviewed by the audit, risk and compliance committee to ensure they do not impact on the impartiality

and objectivity of the auditor; and

yy none of the services undermine the general principles relating to auditor independence as set out in Accounting Professional and

Ethical Standards Board APES 110 Code of Ethics for Professional Accountants.

Auditor’s independence declaration

A copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out on page 22.

Rounding of amounts

The Fund is a registered scheme of a kind referred to in Class Order 2016/191, issued by the Australian Securities and Investments

Commission, relating to the ‘rounding off’ of amounts in the directors’ report and the financial report.

Amounts in the directors’ report and the financial report have been rounded off to the nearest hundred thousand dollars in accordance

with that Class Order.

This report is made in accordance with a resolution of the Directors of the Responsible Entity made pursuant to s298(2) of the

Corporations Act 2001.

Darren Holland

Bruce Carter

Executive Director

Chairman

Sydney Sydney

10 August 2017

10 August 2017